How to Conduct User Research That Actually Works

Learn how to conduct user research that drives real product decisions. Our guide offers actionable insights, real-world examples, and proven methods.

When you're learning how to conduct user research, it’s about more than just checking a box. The process involves setting clear goals, picking the right methods—like interviews or surveys—finding the right people to talk to, gathering the data, and then digging through it all to find those golden nuggets of insight. Get this cycle right, and you'll build products that people actually want to use.

Why Most Insights Are Just Guesswork

Let’s be honest for a second. Building a product based on assumptions is a massive, high-stakes gamble. We've all been in those meetings where someone confidently says, "I'm pretty sure users want this," without a single piece of evidence to back it up. These so-called "insights" are usually just well-intentioned guesswork disguised as strategy.

Acting on them is like trying to navigate a maze blindfolded. You might get lucky and stumble through, but it's far more likely you'll just walk straight into a wall. And trust me, that wall is made of wasted budget and crushed dreams.

The real cost of skipping proper user research isn't just the wasted time and money. It's building features nobody wants, solving problems nobody has, and ultimately, creating a product that completely fails to connect with its audience. Before you even think about research methods, it's critical to understand that guesswork leads to dead ends, while solid research provides the foundation for effective strategies to improve website conversion rates.

The True Value of Genuine User Understanding

Real innovation doesn't come from a boardroom; it comes from understanding the unspoken needs and deep-seated frustrations of your users. I remember one project where the team was dead-set on building a complex, six-figure dashboard. But after just five user interviews, it was painfully obvious all people really wanted was a simple export button. That tiny insight saved the company a fortune and a massive headache.

Another time, a simple observation during a usability test—watching a user repeatedly copy-paste information between two screens—uncovered a million-dollar feature idea that streamlined their entire workflow. These aren't just lucky breaks. They are the direct result of putting genuine user understanding ahead of internal assumptions.

"User research isn't a cost; it's a strategic investment that de-risks your roadmap and fuels innovation. It’s your best defense against building something nobody wants."

From Guesswork to Growth

Bringing user research into your development process isn't just about dodging bullets; it's about unlocking real, tangible growth. The data speaks for itself.

A survey of 800 product professionals found a powerful link between user research and business benefits. Organizations that consistently embed user research into their workflow report:

- 83% improvement in product usability

- 63% higher customer satisfaction

- A 35% better product-market fit

In fact, companies that go all-in on user research see outcomes that are 2.7 times better than those with limited user insights. You can dig into all the details in the findings from the Maze user research report to see the full impact.

This guide is designed to help you conduct research that delivers these kinds of results. We’re going to move beyond the dry definitions and give you a practical, step-by-step roadmap. To kick things off, the table below breaks down the entire research lifecycle, giving you a clear picture of the journey ahead.

The User Research Lifecycle at a Glance

This table offers a high-level overview of the key phases in a typical user research project. Think of it as your map, guiding you from the initial spark of an idea to the final, impactful report.

| Phase | Primary Goal | Key Activities |

|---|---|---|

| Planning | Define clear objectives and scope for the research. | Set goals, formulate research questions, align with stakeholders. |

| Methodology | Select the best methods to answer your questions. | Choose between interviews, surveys, usability tests, etc. |

| Recruitment | Find and screen the right participants for your study. | Create screeners, manage incentives, schedule sessions. |

| Data Collection | Gather qualitative or quantitative data from users. | Conduct interviews, run tests, deploy surveys. |

| Analysis | Synthesize raw data to find patterns and insights. | Affinity mapping, thematic analysis, statistical review. |

| Reporting | Share findings in a compelling and actionable way. | Create reports, presentations, and workshops. |

Each phase builds on the last, ensuring that your final insights are grounded in solid evidence and ready to drive meaningful change.

Crafting Your Research Battle Plan

Diving into user research without a solid plan is a classic mistake. It's like starting a road trip without a map—you'll burn a lot of fuel, probably get lost, and almost certainly end up somewhere you didn't mean to go. A well-thought-out plan is your pre-flight checklist for success, making sure every minute and dollar you invest returns clear, valuable insights.

This isn't about creating pointless bureaucracy or documents that just gather dust. It’s about setting a clear direction to keep your research from spiraling into vague, unusable feedback. Think of your plan as the foundation for everything that follows.

Define Crystal-Clear Research Goals

First things first: you have to know why you're doing this. A fuzzy goal like "understand our users" is a recipe for a messy, unfocused project. Your goals need to be specific, measurable, and directly linked to what the business is trying to achieve.

A great way to start is by asking what specific decisions this research will help make. Are you trying to figure out:

- Why are so many users dropping off during our new onboarding flow?

- How do our power users actually manage their team projects day-to-day?

- What are the biggest points of friction in our current checkout process?

A sharp goal like this completely changes your approach. Figuring out why users are dropping off might point you toward in-depth interviews, while learning how they manage projects could call for an observational study.

From Goals to Guiding Questions

Once you’ve nailed down your goals, it’s time to break them down into sharp research questions. These aren't the exact questions you'll ask participants. Instead, they’re the high-level questions your entire research effort is designed to answer—they’re your North Star.

For a goal like, "Understand why users are abandoning their shopping carts," your guiding research questions might look something like this:

- What critical information do users feel is missing on the checkout page?

- Are there unexpected costs or steps that are causing them to stop?

- How does our checkout process stack up against their expectations from other sites?

These questions keep your work tightly focused and prevent you from getting pulled down interesting but ultimately irrelevant rabbit holes. They ensure that the data you collect can be used to make real business decisions. A well-organized strategy is also central to good research data management, making sure your findings are accessible and can be used again later.

The Unsung Hero: Stakeholder Alignment

You could uncover the most brilliant, game-changing insights, but if no one is prepared to act on them, your research becomes little more than an academic exercise. This is where stakeholder alignment—the true unsung hero of user research—comes into play.

Before you even think about recruiting a single participant, get buy-in from the key players. We're talking about folks in product, engineering, marketing, and leadership. Sit down with them, walk them through your research plan, and ask for their input. What are their burning questions? What assumptions are they holding that you can help validate or challenge?

Getting stakeholders involved early doesn't just create buy-in; it turns them into research champions. When they feel a sense of ownership over the questions, they're far more likely to champion the answers.

This kind of proactive collaboration is what ensures your findings won't just sit in a report. It’s what empowers them to drive meaningful change. The investment in tools to support this process is booming for a reason. The global market for user research software was valued at around USD 245.46 million one year and is projected to rocket to an estimated USD 719.94 million within a decade. This growth is driven by the exact need for businesses to build their products with deep user insights.

You can read more about the user research software market growth to get a sense of the industry's direction. This isn't just a fleeting trend; it’s a fundamental shift in how the most successful products get built. Your battle plan is the first step toward joining the teams that build with confidence, not guesswork.

Choosing the Right Tool for the Job

The world of user research is packed with different methods, and picking the right one can feel like a high-stakes decision. Honestly, it can be overwhelming if you just jump in. Let's move beyond the dry textbook definitions and talk about what these tools actually do in the real world.

Here’s a simple way I like to think about it: if you want to know what users think, you ask them. If you want to see what they actually do, you watch them. That simple distinction is your secret weapon for choosing the right method.

The three heavy hitters you'll use most often are user interviews, usability testing, and surveys. Each one answers a different kind of question, and knowing when to deploy each is a superpower for any product team. The choice you make directly shapes the insights you'll get back.

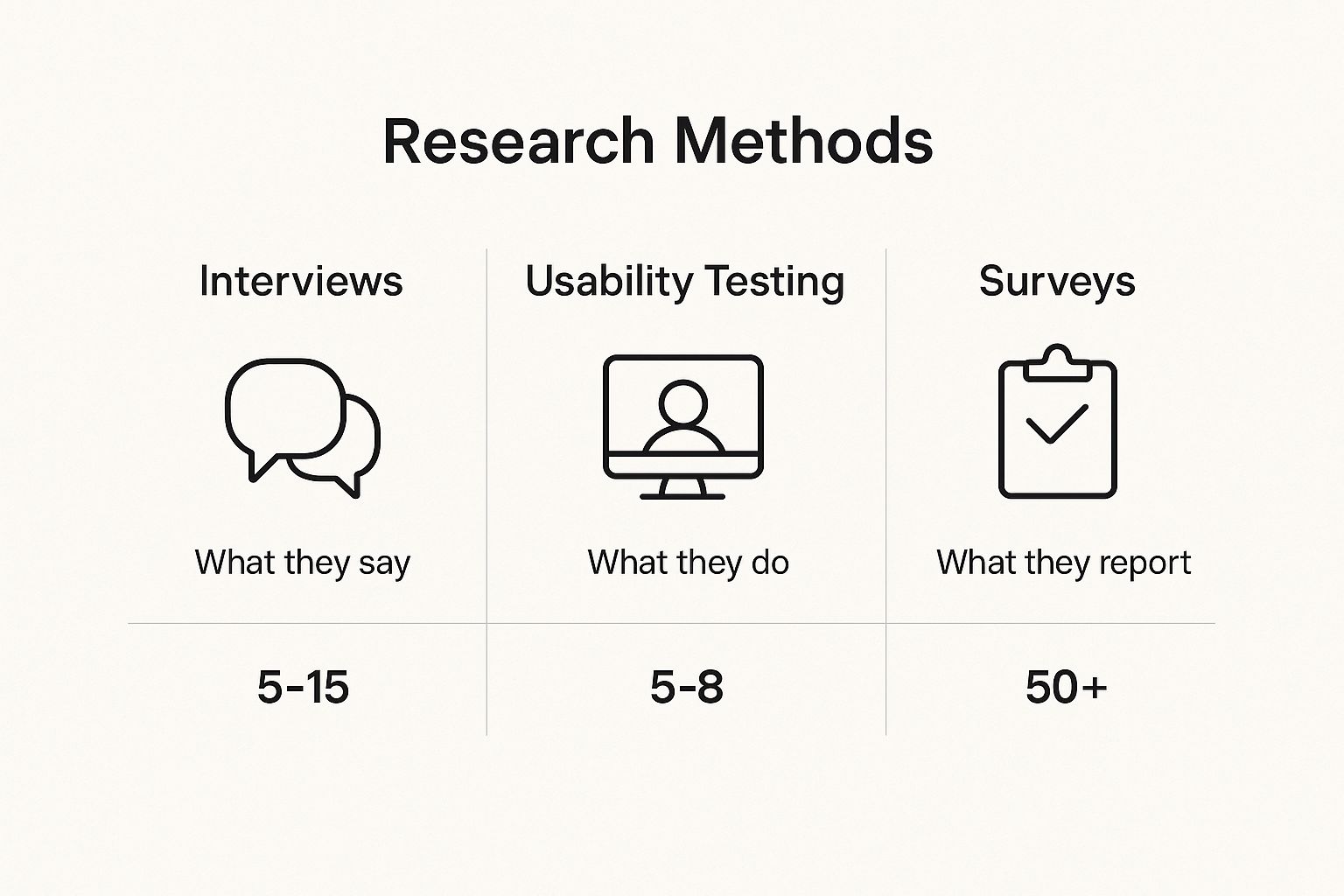

This infographic gives a quick, at-a-glance comparison of these common methods and the typical number of participants you'll need.

As you can see, you can get incredibly rich qualitative insights from just a handful of people with interviews and usability tests. On the other hand, surveys need much larger numbers to give you data you can actually trust.

To make this even clearer, I’ve put together a table to help you match your research question to the best method.

Which User Research Method Should You Use?

Choosing your methodology isn't just a box to check; it determines the very nature of the feedback you'll receive. This table breaks down the core strengths and potential weak spots of the most common methods, helping you decide which tool fits the job.

| Method | Best For Answering | Key Strengths | Potential Pitfalls |

|---|---|---|---|

| User Interviews | "Why do users feel/think/behave this way?" | Deep, contextual insights; uncovers motivations and pain points. | Small sample size; what people say isn't always what they do. |

| Usability Testing | "Can users successfully complete this task?" | Reveals specific friction points and usability issues; provides observable evidence. | Doesn't explain the "why" behind broader user goals; focused on interaction, not motivation. |

| Surveys | "How many users...?" or "What percentage of users...?" | Quantifies attitudes and behaviors at scale; provides statistically significant data. | Lacks context; poor for exploring "why" questions; can be easily biased by leading questions. |

Ultimately, the best approach often involves a mix of these methods. For example, you might use interviews to discover a problem, then run a survey to see how widespread it is.

When to Conduct User Interviews

User interviews are your go-to when you need to understand the why behind user behavior. Think of them as guided conversations, not interrogations. The goal is to uncover the motivations, pain points, and real-world context of your users.

You'll want to run interviews during the early, exploratory stages of a project. They’re perfect for answering foundational questions like:

- What are the biggest challenges people face in their day-to-day workflow?

- How are they currently solving the problem we're trying to address?

- What are their core goals and what truly motivates them?

The narrative insights you get from interviews are invaluable. Hearing those user stories firsthand is one of the most powerful ways to build empathy and get genuine stakeholder buy-in.

When to Use Usability Testing

While interviews tell you what people say, usability testing shows you what they do. This is where the rubber meets the road. You give real users your product or a prototype and watch them try to complete specific tasks. It's hands-down the best way to find out where your design is confusing, frustrating, or just plain broken.

Usability testing is your best friend when you have something tangible to test, whether it’s a rough wireframe or a fully-built product. It's designed to answer questions like:

- Can users figure out the checkout process without any help?

- Where do they get stuck when trying to find a specific feature?

- Is the navigation as intuitive as we think it is?

The key here is observing behavior, not just gathering opinions. Watching someone struggle with an interface provides undeniable proof that a design isn't working as intended. To speed up the process, you can explore various AI tools for research that help with transcription and analysis, freeing you up to focus on observing the user.

When Surveys Are the Right Choice

When you need to understand how many or how much, surveys are your best bet for gathering quantitative data at scale. A well-designed survey can deliver statistically significant answers that a handful of interviews never could.

Reach for a survey when you need to:

- Measure overall customer satisfaction (CSAT) or loyalty (NPS).

- Validate findings from your qualitative research with a much larger audience.

- Gather demographic data to better understand your user base.

A common mistake is trying to use surveys to ask deep "why" questions. While you can include an open-ended question or two, a survey's real power is in collecting structured data from a large group to spot trends and patterns.

Let's imagine you're redesigning an e-commerce checkout flow. To explore user frustrations with the current system, you’d start with user interviews. Once you have a prototype of the new design, you'd run usability tests to see if it’s actually easier to use. Finally, after launch, you could deploy a survey to measure its impact on overall user satisfaction. Combining methods like this gives you the complete picture.

Finding People Who Tell the Truth

You can have the most brilliant research plan in the world, but if you're talking to the wrong people, your insights will be useless at best and dangerously misleading at worst. This part of the process—finding participants who will give you genuine, thoughtful feedback—is both an art and a science. It's the difference between collecting rich data and just collecting noise.

The goal isn't just to find anyone willing to talk for 30 minutes. It's about finding people who truly represent your target user. This is where all that initial work crafting your research plan pays off, because you've already defined who you need to speak with.

Creating Screeners That Actually Work

Your first line of defense against poor-quality feedback is a solid screener survey. This is a short questionnaire designed to filter out people who don't fit your ideal participant profile. Think of it as a bouncer for your research study—its job is to let the right people in and politely turn everyone else away.

A great screener goes beyond simple demographics. It needs to dig into actual behaviors and attitudes. For example, instead of asking, "Do you use project management software?" which invites a simple "yes," try asking behavioral questions like these:

- "How many times in the past week have you assigned a task to a colleague using a digital tool?"

- "Which of the following best describes your role in managing team projects?" (followed by specific options).

Questions like these force people to reflect on their real habits, which is a much more reliable indicator of whether they're the right fit for your study.

Where to Find Your Participants

Once your screener is ready, you need to get it in front of the right eyeballs. There are several channels you can use, and each has its own strengths.

- Your Own Customer List: This is often the best place to start. These are people already familiar with your product, making them perfect for studies on existing features or workflows.

- Social Media and Online Communities: Platforms like LinkedIn, Reddit, or specialized Slack channels can be goldmines for finding people with specific professional backgrounds or interests.

- Specialized Recruitment Agencies: When you need high-quality, vetted participants but don't have time for the legwork, using a dedicated service is the way to go. Platforms like Zemith can connect you with a pool of qualified individuals, taking the headache out of recruitment so you can focus on the research itself.

Keep in mind that your users could be anywhere. Interestingly, the adoption of user research tools reflects this global reality. North America currently holds the largest market share for UX research software at about 41.2%, but the Asia-Pacific region is the fastest-growing market, driven by a booming startup scene and increasing internet access.

The "Professional Tester" Problem

A quick word of warning: beware the "professional tester." I learned this lesson the hard way once. We recruited a participant for a usability study who gave the most perfect, articulate, insightful feedback I’d ever heard. It was almost too good. A little digging revealed he was part of a network of people who did multiple paid studies a day, giving polished but completely generic feedback. His insights were useless because they weren't genuine.

That experience taught me a valuable lesson: authentic feedback, with all its messiness and imperfections, is infinitely more valuable than polished feedback from someone who isn't a real user. Your screener is your best tool for weeding these people out.

To really get to the truth, mastering direct conversation is key. Learning how to conduct effective user interviews will help you get the most out of every single session.

Finally, don't forget about incentives. You're asking people for their valuable time, and it's important to compensate them fairly. The amount can vary based on the length of the session and the type of participant you need, but a good rule of thumb is to offer an amount that shows you respect their contribution. Gift cards are usually a safe and easy bet.

Finding the Signal in the Noise

You've done the hard work. The interviews are wrapped up, your notebook is overflowing with quotes, and you're staring at a mountain of observations. It’s easy to feel a little overwhelmed at this point, but this is where the magic happens—where raw data turns into strategic gold. This is how we find the signal in the noise.

Analysis isn't some mystical process reserved for data scientists. At its core, it's about spotting patterns, connecting the dots, and uncovering the unspoken needs hiding just beneath the surface of what people say. The whole point is to move from a pile of "what we heard" to a clear mandate for "what we must do next."

Turning Observations into Insights

The biggest mistake I see teams make here is simply listing off what they saw. An observation tells you what happened, but an insight tells you why it matters.

For example, observing that "three out of five users couldn't find the export button" is just a fact. The real insight is digging into why—maybe you realize "the export button's icon is confusing, making users think it’s a 'share' function instead."

That "why" is where the real value lies. It's the difference between documenting a problem and truly understanding its root cause, which is the only way to design a solution that actually works. An AI-powered workspace like Zemith is a game-changer here, helping you instantly analyze transcripts and spot those crucial "why" moments.

One of the most effective ways to get to these insights is a technique called affinity mapping. It sounds fancy, but it’s really just a structured way to organize chaos, usually with sticky notes. It’s a beautifully simple process that lets themes and patterns emerge organically from your data.

Your Guide to Affinity Mapping

Let's imagine you've just finished five interviews for a new project management tool. Your notes are a jumble of direct quotes, pain points, and off-the-cuff feature ideas. Here’s how you’d use affinity mapping to make sense of it all.

- Get everything on a note: First, go through all your notes and write every single distinct observation, quote, or idea onto its own sticky note. Don't filter or judge anything yet. If someone said, "I hate the color of the sidebar," that gets a note. If they said, "I need to assign sub-tasks," that gets a note, too.

- Start clustering: Now, lay out all your sticky notes on a wall or a digital whiteboard. Just start looking for notes that feel like they belong together. You're not trying to name the categories yet; you're just intuitively grouping related ideas. A note about "confusing notifications" might end up next to one about "too many emails."

- Name the groups: Once you have several solid clusters, it's time to give each one a name that captures its core theme. For instance, a cluster of notes about notifications, emails, and pop-ups might become "Communication Overload." Another group about assigning tasks and setting deadlines could be labeled "Team Collaboration Issues."

- Find the core insights: Finally, look at your named groups. What are the big stories they're telling you? That "Communication Overload" group might lead you straight to a powerful insight: "Users feel overwhelmed and distracted by our current notification system, causing them to miss important updates."

This simple process helps you move from hundreds of individual comments to just a handful of powerful, actionable insights that can directly inform your product roadmap. For a more detailed breakdown, you can learn more about how to analyze qualitative data in our dedicated guide.

An observation tells you what happened. An insight tells you why it matters and what to do about it. Focus on uncovering the why behind user behavior, not just documenting what you saw.

The analysis phase is where the real value of your user research is finally unlocked. It’s how you ensure your next moves are grounded in a genuine understanding of your users' needs, not just guesses. This is how you build a solid foundation for a product people will actually love to use.

Sharing Insights People Will Actually Use

Let’s be honest. The most brilliant research study is a complete waste of time if the findings die in a forgotten slide deck. After you've poured all that effort into planning, recruiting, and analyzing, you face the final—and most critical—hurdle: sharing what you've learned in a way that actually sparks action. This isn’t about just dumping data. It's about telling a powerful story.

Your real job here is to turn a dry report into a compelling narrative that grabs the attention of busy executives and overloaded product teams. Forget the 50-page tome nobody will read. We need to be concise, empathetic, and laser-focused on the opportunities you've uncovered.

From Data Points to Human Stories

If you want to create real empathy, the most powerful tool in your arsenal is showing, not telling. People forget numbers on a slide, but they will never forget watching a real person visibly struggle with your product.

A well-edited highlight reel—just a couple of minutes showing users sighing in frustration, getting hopelessly lost in the navigation, or voicing their confusion out loud—can drive change faster than any statistic. It’s crucial to frame these moments not as user failures, but as glaring opportunities for us to do better.

"A well-chosen video clip of a user struggling is worth a thousand data points. It shifts the conversation from abstract problems to tangible human experiences, making the need for a solution urgent and undeniable."

Making Insights Actionable and Collaborative

Once you’ve distilled your key insights, the work is only half done. You have to get them out of your head and into the hands of the people who can actually build the solutions. I’ve found that running collaborative workshops with the product, design, and engineering teams is the most effective way to do this.

Don't just present at them; turn it into a working session. A great workshop formula I often use includes:

- Sharing the highlights: Kick things off by walking through your top 3-5 insights. Back each one up with a powerful user quote or, even better, a short video clip.

- Brainstorming solutions: Next, break everyone into smaller, cross-functional groups. Task them with brainstorming features or fixes that directly address the problems you just showed them.

- Prioritizing next steps: Finally, bring everyone back together to share their ideas and start mapping out a plan. Who owns what? What's a quick win versus a long-term bet? This is where the work gets real.

This collaborative approach flips the script, turning your stakeholders from a passive audience into active problem-solvers. It guarantees your hard-won insights become the catalyst for meaningful improvements, not just another check-the-box meeting. Using a tool like Zemith to create and share your findings in a centralized project space makes this entire process a breeze.

The Power of the One-Page Summary

No one has time to read a massive report. I’ve learned this the hard way. To make sure your key messages stick, always create a simple, one-page summary that anyone can digest in five minutes. This single document becomes your secret weapon for keeping the research top-of-mind.

Your one-pager needs to be ruthlessly concise and easy to scan. Here’s a simple structure that works every time:

- Key Problems: Clearly list the top 3-4 user pain points you identified. Use simple, direct language.

- Supporting Evidence: For each problem, add a killer quote or a single, impactful data point as proof.

- Actionable Recommendations: Provide a clear, specific recommendation for what the team should do next. No vague suggestions.

This simple document is incredibly effective. It ensures even the most time-crunched executive can grasp the core findings, and it helps your research continue to influence decisions long after the presentation ends. It's the final step in learning how to conduct user research that truly makes an impact.

Common User Research Questions Answered

When you’re just starting out in user research, a few questions always seem to surface. I've been asked these countless times over the years. Let's walk through some of the most common hurdles so you can get started with confidence.

How Many Participants Do I Really Need?

This is the classic "it depends" question, but I can give you some solid guideposts. The right number of participants hinges entirely on what you’re trying to find out.

For qualitative studies, like usability testing, the sweet spot is often just five users. This isn't a random number; extensive research has shown that this small group can reveal about 85% of the most glaring usability problems. You're not aiming for statistical significance here; you're looking for patterns. Trust me, after you see the third or fourth person stumble over the exact same button, you've found a critical insight.

Quantitative methods like surveys are a whole different ballgame. To get data you can confidently apply to your entire user base, you'll need a much larger sample size, usually in the hundreds.

What Is the Difference Between User and Market Research?

It's really easy to mix these two up, but they solve completely different problems. I always explain it like this:

- Market research answers the question, "What should we build?" It’s all about the big picture—sizing up the market, spotting trends, and checking out the competition to find a viable business opportunity.

- User research answers, "How should we build it?" This is where you get granular, focusing on real people's behaviors, needs, and frustrations to make sure the thing you build is actually useful and intuitive.

Market research might tell you there's a huge demand for a new fitness app. But it’s user research that reveals people can't figure out how to log a workout in your prototype. You need both, but they play very different roles.

Market research tells you people want to eat healthier; user research shows you they can’t open your protein bar’s packaging.

How Can I Do This on a Shoestring Budget?

Good news: you absolutely do not need a massive budget. Some of the most powerful insights I've ever found came from scrappy, low-cost "guerrilla" research tactics.

Here are a few ways to get started with little to no money:

- Coffee Shop Testing: Find a cafe where your target users hang out. Offer to buy someone a coffee in exchange for 15 minutes of their time to get feedback on a prototype. It's surprisingly effective.

- Free Survey Tools: Platforms like Google Forms are perfect for running simple surveys to collect quantitative feedback without spending a dime.

- Mine Existing Data: Your company is already sitting on a goldmine of free feedback. Dive into support tickets, app store reviews, and social media comments to find common complaints and feature requests.

The most important thing to remember is that some insight is always better than flying blind.

How Do I Get My Boss to Care About This?

Ah, the stakeholder buy-in challenge. This is a big one. To get leadership on board, you have to speak their language, which almost always comes down to two things: risk and money.

Frame user research as a powerful risk-mitigation tool. It costs a whole lot less to spend a few days interviewing users than it does to sink six months of development time into a feature nobody wants. My advice? Start with a small, focused pilot project and aim for a quick, undeniable win.

When you present your findings, connect them to a tangible return on investment. For example, you could say, "This one-day research sprint uncovered a major flaw that would have cost us two months of engineering time to fix after launch." Showing a clear financial impact is the fastest way to turn a skeptic into your biggest supporter.

Ready to turn these answers into action? Zemith provides an all-in-one AI workspace that can supercharge your research process. From analyzing interview transcripts with the Document Assistant to organizing findings in smart projects, Zemith helps you find the signal in the noise faster than ever. Start making data-driven decisions today by exploring all the tools at https://www.zemith.com.

Explore Zemith Features

Introducing Zemith

The best tools in one place, so you can quickly leverage the best tools for your needs.

All in One AI Platform

Go beyond AI Chat, with Search, Notes, Image Generation, and more.

Cost Savings

Access latest AI models and tools at a fraction of the cost.

Get Sh*t Done

Speed up your work with productivity, work and creative assistants.

Constant Updates

Receive constant updates with new features and improvements to enhance your experience.

Features

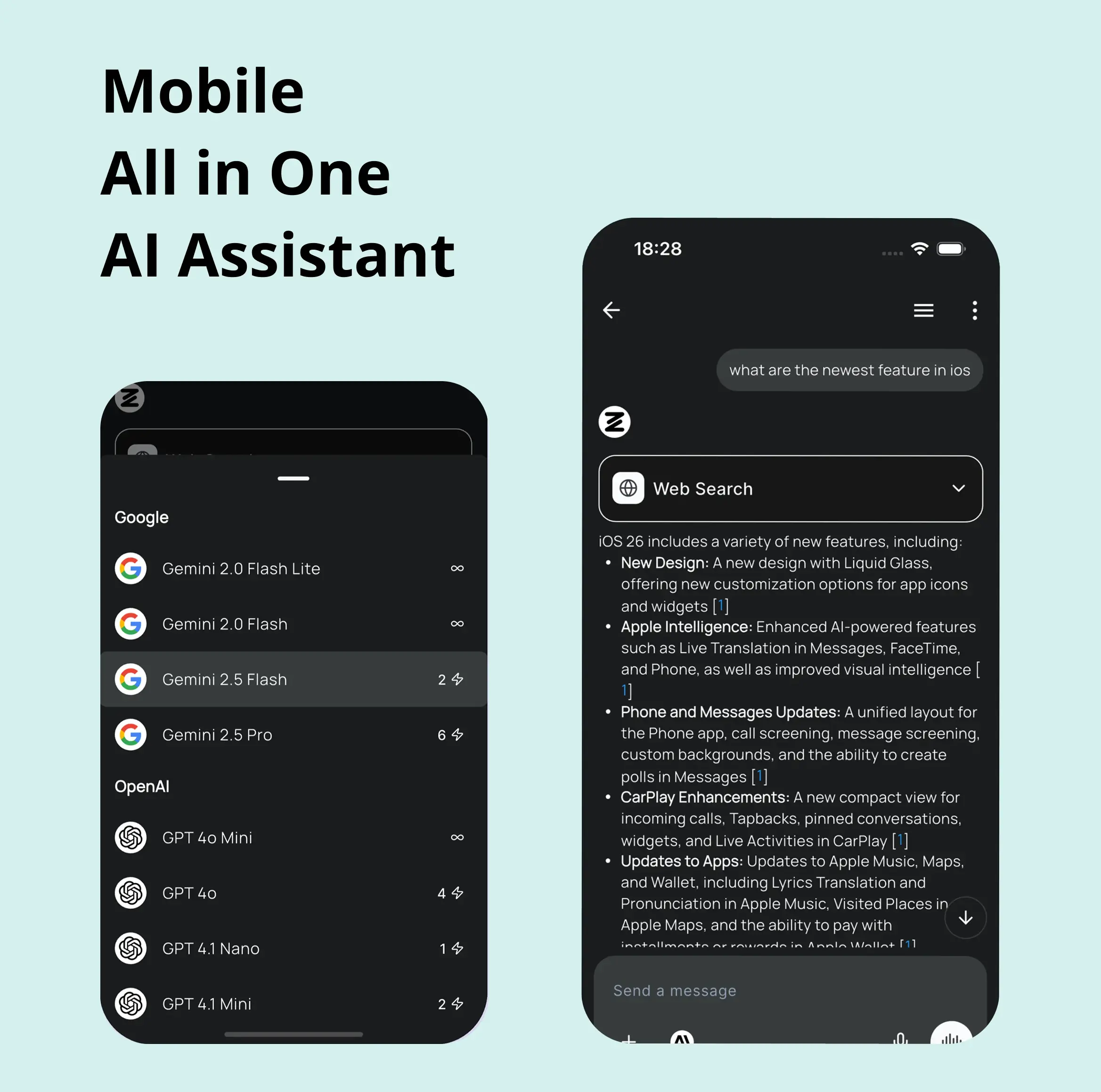

Selection of Leading AI Models

Access multiple advanced AI models in one place - featuring Gemini-2.5 Pro, Claude 4.5 Sonnet, GPT 5, and more to tackle any tasks

Speed run your documents

Upload documents to your Zemith library and transform them with AI-powered chat, podcast generation, summaries, and more

Transform Your Writing Process

Elevate your notes and documents with AI-powered assistance that helps you write faster, better, and with less effort

Unleash Your Visual Creativity

Transform ideas into stunning visuals with powerful AI image generation and editing tools that bring your creative vision to life

Accelerate Your Development Workflow

Boost productivity with an AI coding companion that helps you write, debug, and optimize code across multiple programming languages

Powerful Tools for Everyday Excellence

Streamline your workflow with our collection of specialized AI tools designed to solve common challenges and boost your productivity

Live Mode for Real Time Conversations

Speak naturally, share your screen and chat in realtime with AI

AI in your pocket

Experience the full power of Zemith AI platform wherever you go. Chat with AI, generate content, and boost your productivity from your mobile device.

Deeply Integrated with Top AI Models

Beyond basic AI chat - deeply integrated tools and productivity-focused OS for maximum efficiency

Straightforward, affordable pricing

Save hours of work and research

Affordable plan for power users

Plus

- 10000 Credits Monthly

- Access to plus features

- Access to Plus Models

- Access to tools such as web search, canvas usage, deep research tool

- Access to Creative Features

- Access to Documents Library Features

- Upload up to 50 sources per library folder

- Access to Custom System Prompt

- Access to FocusOS up to 15 tabs

- Unlimited model usage for Gemini 2.5 Flash Lite

- Set Default Model

- Access to Max Mode

- Access to Document to Podcast

- Access to Document to Quiz Generator

- Access to on demand credits

- Access to latest features

Professional

- Everything in Plus, and:

- 21000 Credits Monthly

- Access to Pro Models

- Access to Pro Features

- Access to Video Generation

- Unlimited model usage for GPT 5 Mini

- Access to code interpreter agent

- Access to auto tools

- 10000 Credits Monthly

- Access to plus features

- Access to Plus Models

- Access to tools such as web search, canvas usage, deep research tool

- Access to Creative Features

- Access to Documents Library Features

- Upload up to 50 sources per library folder

- Access to Custom System Prompt

- Access to FocusOS up to 15 tabs

- Unlimited model usage for Gemini 2.5 Flash Lite

- Set Default Model

- Access to Max Mode

- Access to Document to Podcast

- Access to Document to Quiz Generator

- Access to on demand credits

- Access to latest features

- Everything in Plus, and:

- 21000 Credits Monthly

- Access to Pro Models

- Access to Pro Features

- Access to Video Generation

- Unlimited model usage for GPT 5 Mini

- Access to code interpreter agent

- Access to auto tools

What Our Users Say

Great Tool after 2 months usage

simplyzubair

I love the way multiple tools they integrated in one platform. So far it is going in right dorection adding more tools.

Best in Kind!

barefootmedicine

This is another game-change. have used software that kind of offers similar features, but the quality of the data I'm getting back and the sheer speed of the responses is outstanding. I use this app ...

simply awesome

MarianZ

I just tried it - didnt wanna stay with it, because there is so much like that out there. But it convinced me, because: - the discord-channel is very response and fast - the number of models are quite...

A Surprisingly Comprehensive and Engaging Experience

bruno.battocletti

Zemith is not just another app; it's a surprisingly comprehensive platform that feels like a toolbox filled with unexpected delights. From the moment you launch it, you're greeted with a clean and int...

Great for Document Analysis

yerch82

Just works. Simple to use and great for working with documents and make summaries. Money well spend in my opinion.

Great AI site with lots of features and accessible llm's

sumore

what I find most useful in this site is the organization of the features. it's better that all the other site I have so far and even better than chatgpt themselves.

Excellent Tool

AlphaLeaf

Zemith claims to be an all-in-one platform, and after using it, I can confirm that it lives up to that claim. It not only has all the necessary functions, but the UI is also well-designed and very eas...

A well-rounded platform with solid LLMs, extra functionality

SlothMachine

Hey team Zemith! First off: I don't often write these reviews. I should do better, especially with tools that really put their heart and soul into their platform.

This is the best tool I've ever used. Updates are made almost daily, and the feedback process is very fast.

reu0691

This is the best AI tool I've used so far. Updates are made almost daily, and the feedback process is incredibly fast. Just looking at the changelogs, you can see how consistently the developers have ...